存储抵押

Conflux Core 引入了存储抵押物(CFS)机制,作为使用存储空间的定价方法。 与以太坊的一次性存储费用相比,CFS 机制更加公平合理。 原则上,该机制需要锁定一定数量的资金作为抵押品,以占用存储空间。 这些抵押资金将保持锁定,直到相应的存储空间释放或被其他人接管。 锁定的抵押资金产生的利息将直接分配给矿工,以维护存储空间。 因此,Conflux 中的存储成本也取决于占用存储空间的持续时间。 Conflux 在其 Conflux 协议规范的第 7 章详细描述了这一机制。

存储成本的计算

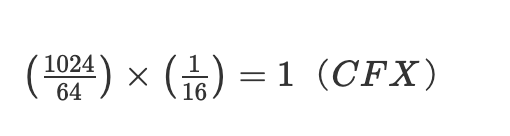

在 Conflux 网络中,每个存储条目占用 64B (B 是字节),这是在世界状态中键/值对的大小。 需要注意的是,区块链中的键通常长度为 256 位,值的长度也为 256 位(每个长 32B,总共 64B)。 存储所需的押金与能涵盖的所有存储项的 64B 的最小倍数成正比。 在世界状态中,在存储抵押物的整个周期中,抵押物所有者必须锁定一定量的 CFX 作为存储抵押金。 具体来说,对于每 64 字节的存储条目,所有者将锁定 1/16 个 CFX。 占用 1KB 空间,您将支付 1CFX 作为押金。 相应的公式如下:

存储的所有权

对于每条存储,最后一个写入该条目的账户会被视为此存储条目的所有者。 存储的所有者需要为存储条目支付存储抵押。

如果在合约 C 的执行中写入了一个存储条目,并且该合约对抵押物有赞助,则 C 被视为对该条目的写入账户,因此相应地会成为所有者(详情请参见 Conflux 协议规范 for more details)第 8.1 节)。

当账户 α 成为存储条目的所有者(无论是通过创建还是修改),α 必须立即为该条目锁定 1/16 CFX。 如果 α 账户内有足够的余额,所需的押金将被自动锁定。 然而,如果 α 账户内的余额不足,操作将失败,不能创建或修改该条目。

如果合约被代付了,代付方将支付存储条目的存储抵押,然后代付方将成为这个存储条目的所有者。 如果合约的代付方发生变更,新的代付方将支付存储条目的存储抵押,成为新的所有者。

抵押物的退还

当存储物品从世界状态中删除时,相应的 1/16 CFX 押金将解锁并退还到物品所有者的余额中。

如果存储物品的所有权发生变更,上一个所有者的 1/16 CFX 押金将解锁,新的所有者必须同时锁定 1/16 CFX 作为他们的押金。

需要注意的是,押金退款会“悄无声息”的加入余额;没有可供查询的转账交易。

在交易中指定存储抵押

当用户发送 Conflux Core 交易时,他们必须填写storageLimit 字段(以字节为单位)。 用于存储的存储限制的功能类似于 gas limit 它设置了一个 gas 上限,规定了执行交易前后存款支付者的存款增加不得超过存储上限乘以 1/1024 CFX。 如果这个值设置得太低,执行交易后的押金可能超过上限,导致交易失败。 因此,这个字段通常需要设置得高于实际的 gas 使用量,多余的部分不会产生存储抵押。 然而,我们也不推荐设置过高的 gas limit,因为者可能导致余额不足以支付押金,从而导致交易失败。 全节点提供 RPC 方法 cfx_estimateGasAndCollateral 可以用来估计交易将使用的存储大小。

执行交易后,收据将包括几个与存储更改相关的字段:

storageCollateralized:显示存储抵押的数据。storageCoveredBySponsor:表示此交易的存储抵押是否由赞助者支付。storageReleased:此交易释放的存储数量。

可以使用 cfx_getCollateralForStorage 方法来查询地址当前抵押的存储大小;单位是字节。 抵押的 CFX 金额可以通过将此值除以 1024 来计算。 此外,这些信息也可以通过 cfx_getAccount 方法获得。 返回的信息包括 collateralForStorage 字段。

赞助机制与 CIP-107

Conflux 实现了一种赞助机制 ,用于赞助智能合约的使用费用。 这种机制允许合约的赞助者来支付交易占用的存储抵押,而不是由交易的发送者支付。

在 v2.3.0 版本的硬分叉之后,激活了 CIP-107 。 这引入了存储点作为新类型的存储抵押,其中每 1 KB 的存储空间成本为 1,024 存储点。

当覆盖的存储空间被释放或其所有权发生变化时,抵押的存储点也会随之退还。 然而,需要要注意的是,这些存储点是不可转让的,并且不会产生存储利息。

有关赞助机制和 CIP-107 的更多详细信息,请参考赞助机制 以及 CIP-107 DAO 可调控的存储抵押的销毁机制。

常见问题解答

eSpace 中有存储抵押吗?

没有。 存储抵押机制仅适用于 Conflux Core Space。